Walkthrough - StrategyV2 Script

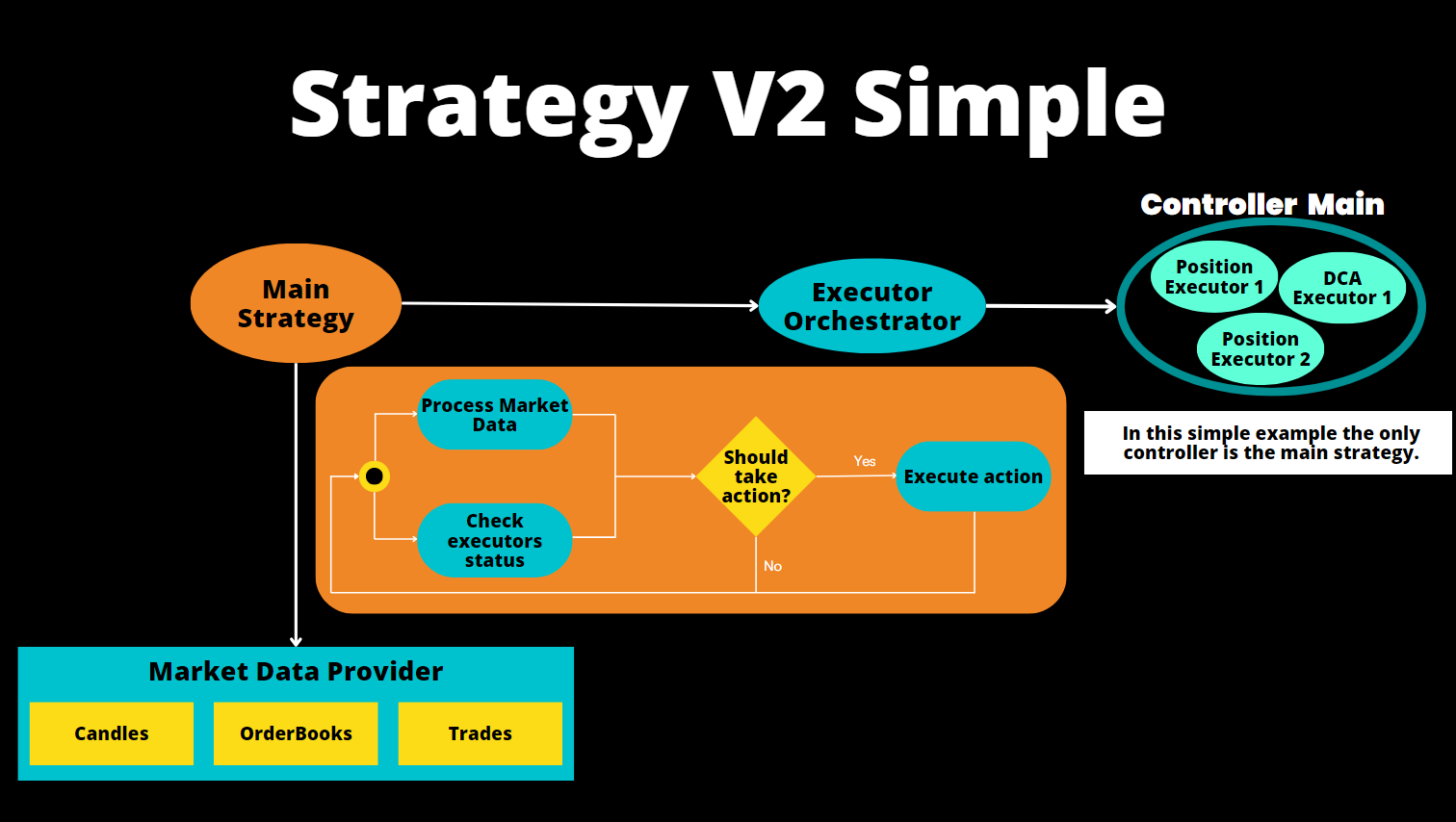

Below, we provide a walkthrough to illustrate the StrategyV2 framework, which we recommend for new users who want to understand how the framework works. Afterwards, check out Walkrough - Controller to learn how to run scripts that use Controllers.

What we'll cover¶

In this example, we'll show you how to configure and run a simple directional trading strategy using the v2_simple_directional_rsi.py starter script.

This strategy executes trades on a spot or perpetual exchange based on the RSI signals from the Market Data Provider, creating buy actions when the RSI is below a low threshold (indicating oversold conditions) and sell actions when the RSI is above a high threshold (indicating overbought conditions).

After each trade, the strategy utilizes the Position Executor component, which uses a triple barrier configuration to manage the P&L of the position or filled order.

Create script config¶

First, let's create a script config file that defines the key strategy parameters.

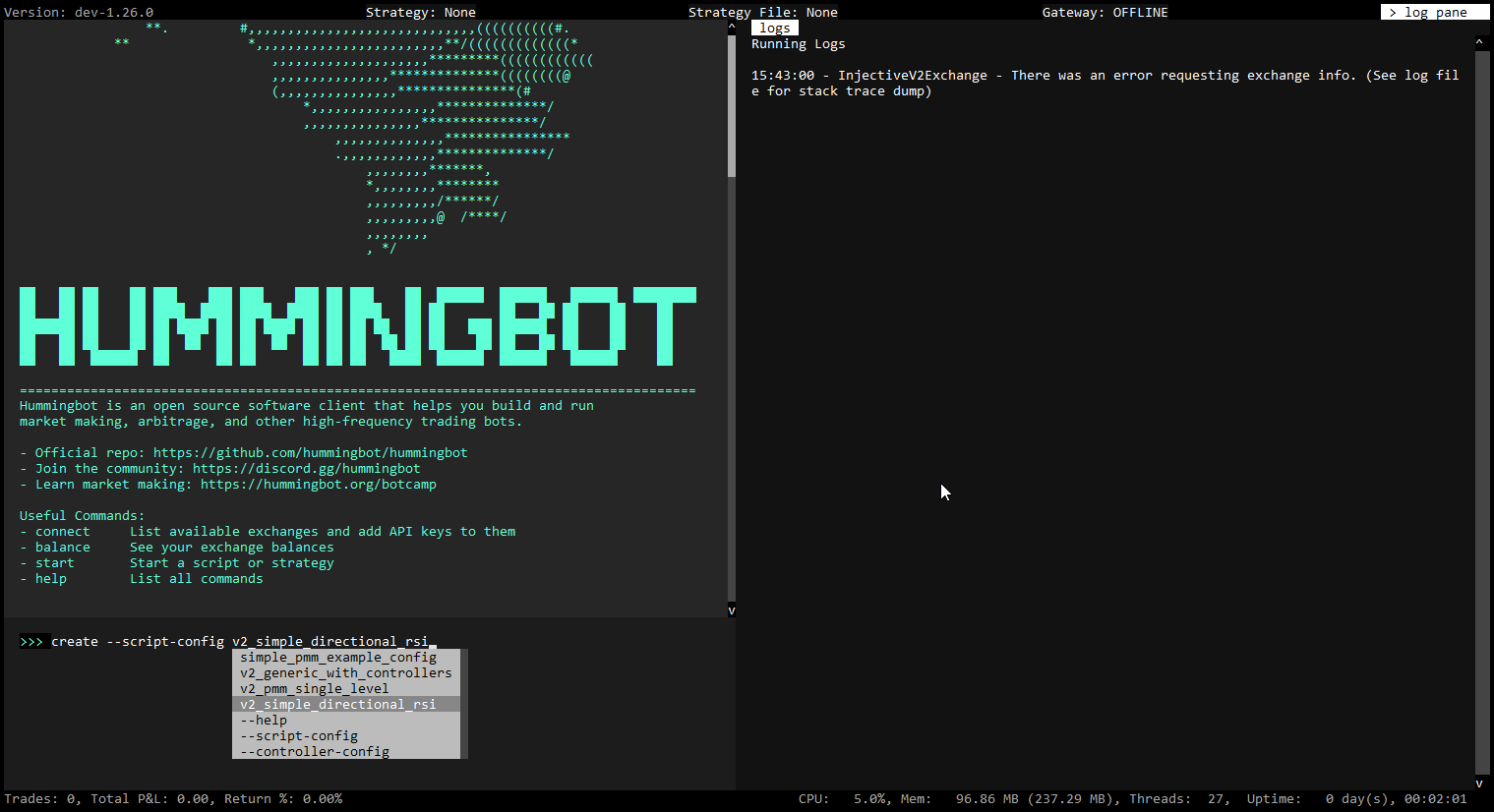

Launch Hummingbot and execute the command below to generate your script configuration:

This command auto-completes with the subset of configurable scripts from the local /scripts directory.

You'll be prompted to specify the strategy parameters, which are then saved in a YAML file within the conf/scripts directory:

Enter markets in format exchange1.tp1,tp2:exchange2.tp1,tp2 >> binance_perpetual.JASMY-USDT,RLC-USDT

Enter the RSI period >> 14

Enter the RSI low >> 30

Enter the RSI high >> 70

Enter the interval >> 3m

Enter the amount of quote asset to be used per order >> 30

Enter the leverage >> 20

Enter the position mode (HEDGE/ONEWAY): >> HEDGE

Enter the stop loss >> 0.03

Enter the take profit >> 0.01

Enter the time limit in seconds >> 2700

Enter a new file name for your configuration >> conf_v2_simple_directional_rsi_1.yml

Run the script¶

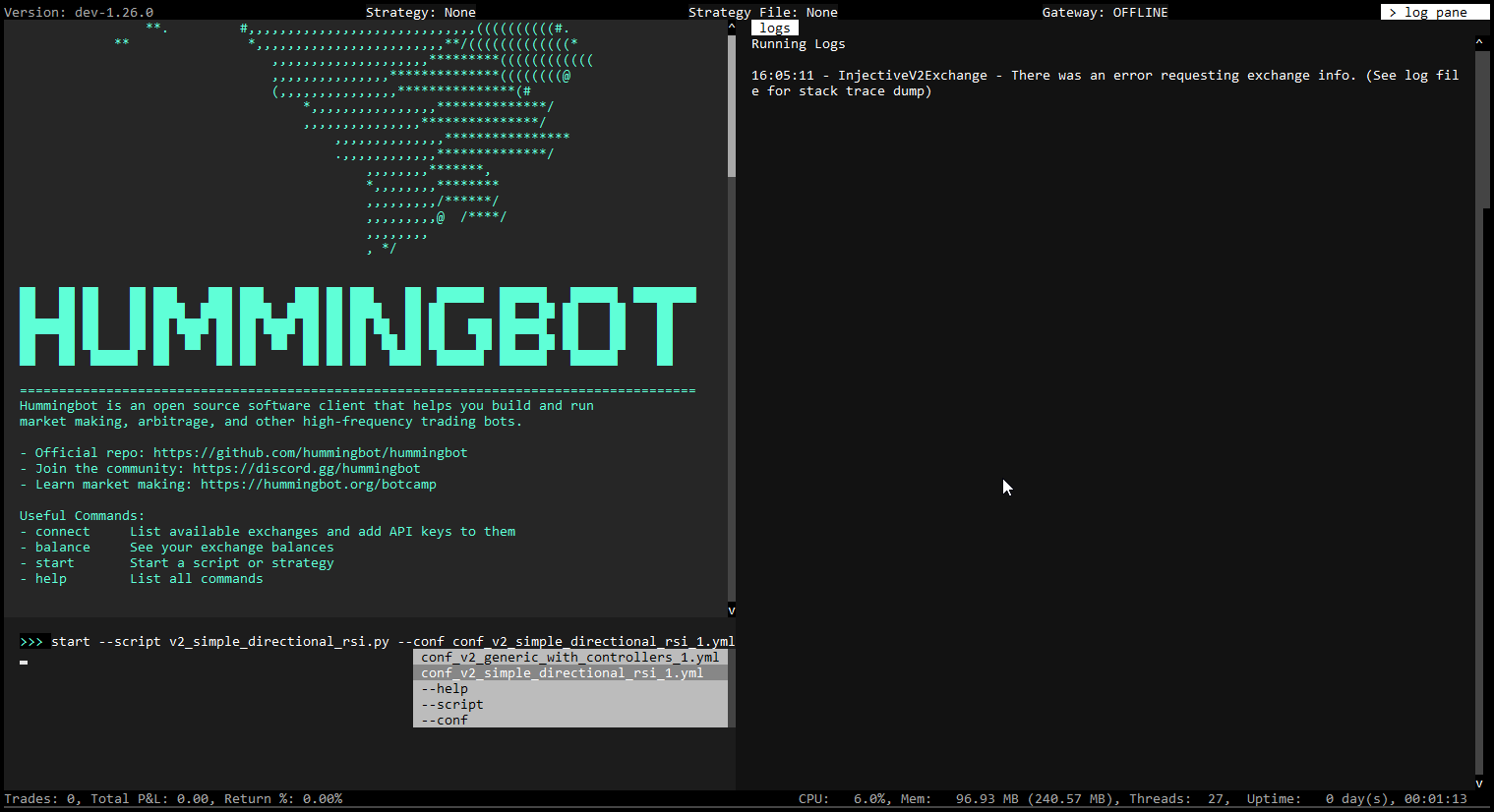

Execute the command below to start the script:

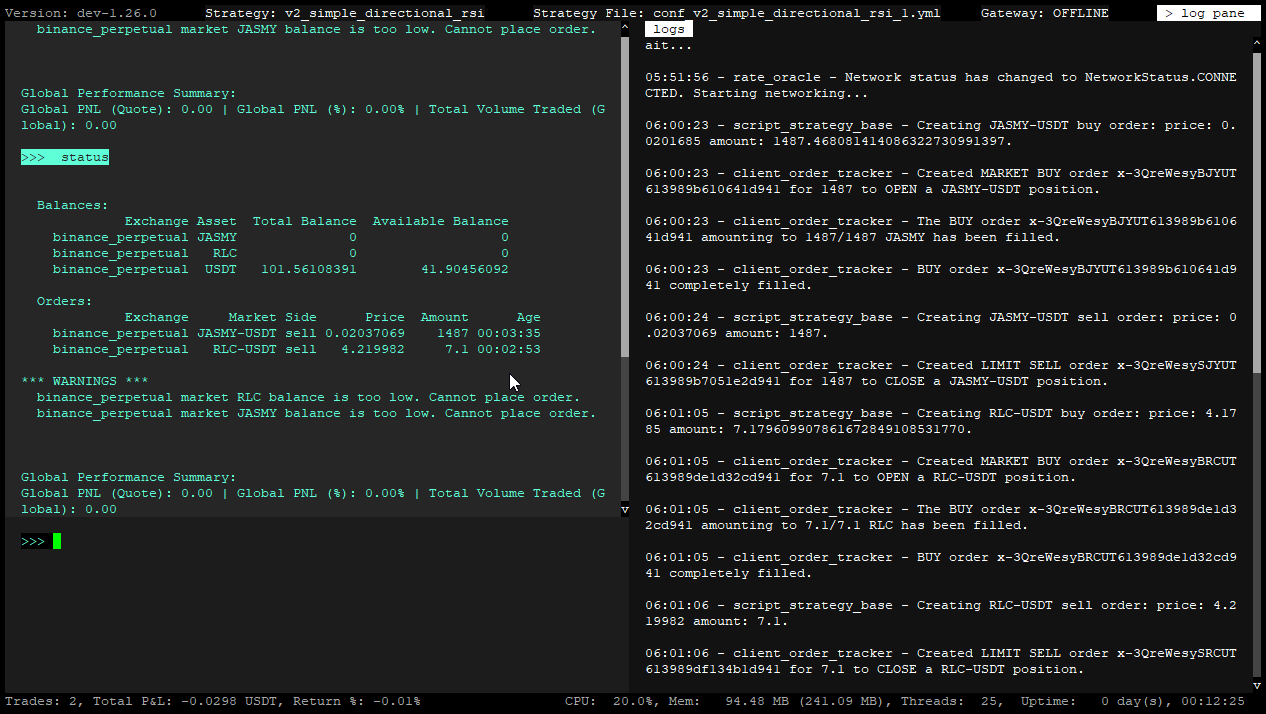

The strategy makes a series of market checks and initializes the market data provider. Afterwards, it should start placing orders for both pairs.

Run the status command to see the status (asset balances, active orders and positions) of the running strategy: